What is stock price adjustment

1. What is stock price adjustment?

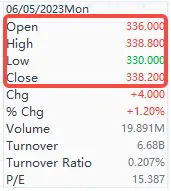

Listed companies may choose to issue dividends or additional shares. These corporate actions can impact stock prices and create gaps in the price chart, as shown below. Stock price adjustments are used to reconcile corporate actions that result in stock price changes.

A stock price adjustment involves aligning historical stock prices and trading volume to the latest price, dividend or stock split data. The purpose is to ensure continuity between historical and recent prices, avoiding gaps caused by corporate actions.

2. Types of stock price adjustments

There are three types of price adjustments available:

-

Backward Adjusted (Default)

-

Unadjusted

-

Forward Adjusted

2.1 Backward Adjusted

A backward adjustment for a stock price is a type of adjustment made to historical stock prices to reflect price changes or events, such as corporate actions. Historical prices of a stock are adjusted to account for stock splits, dividends or other corporate actions that affect the stock price. A backward adjustment is the most common type of price adjustment.

Example: A stock trading at $10 per share undergoes a 2 for 1 split, reducing its price to $5 per share. With no price change on the day of the split, the previous day's stock price will also be adjusted to $5 per share, with earlier prices adjusted downwards accordingly.

Purpose: This type of adjustment accurately represents the stock's historical performance and return.

2.2 Unadjusted

The unadjusted trading price of the day will be used as the closing price without adjusting it for dividends, splits or other corporate actions. This method can lead to gaps in the stock price charts, which may not accurately reflect the stock's actual performance.

Example: If a stock's price drops by 10% due to an ex-rights or ex-dividend event, historical data would be kept the same based on the actual price on that day without adjusting for the current event's impact.

Purpose: The unadjusted stock prices can accurately reflect the historical ex-rights information of the stock price.

2.3 Forward Adjusted

A forward adjustment is a type of adjustment made to a stock's price for the days after an event that affects a stock's price, such as a corporate event. Prices of a stock after the event, in the future, are adjusted to account for a stock split, dividend or other corporate actions. Historical prices remain unchanged.

Example: A stock's price drops from $10 to $5 per share due to ex-dividend. If there are no other price changes on the ex-dividend day, the adjusted closing price for that day will be recalculated to $10 per share. Future prices will also be scaled up accordingly.

Purpose: Adjusting prices for days following a corporate action provides a clearer picture of the stock's value growth and the actual yield for shareholders.

3. Comparison of stock price adjustments

|

|

Backward Adjusted Prices |

Unadjusted Prices |

Forward Adjusted Prices |

Description |

|

Adjust Prices for Dividends |

|

|

|

Unadjusted prices will create gaps in charts. Adjusting stock prices will remove these gaps and maintain chart continuity. |

|

Adjust Prices for Stock Splits |

|

|

|

|

|

Adjust Prices for Dividends |

|

|

|

Stock price adjustment will affect the opening, highest, lowest, and closing prices.

|

|

Adjust Prices for Stock Splits |

|

|

|

Note: The screenshots and related information are for reference only. Please refer to the latest version of the app. The securities shown in the screenshots are for illustration purposes only and do not constitute any investment advice.

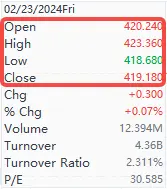

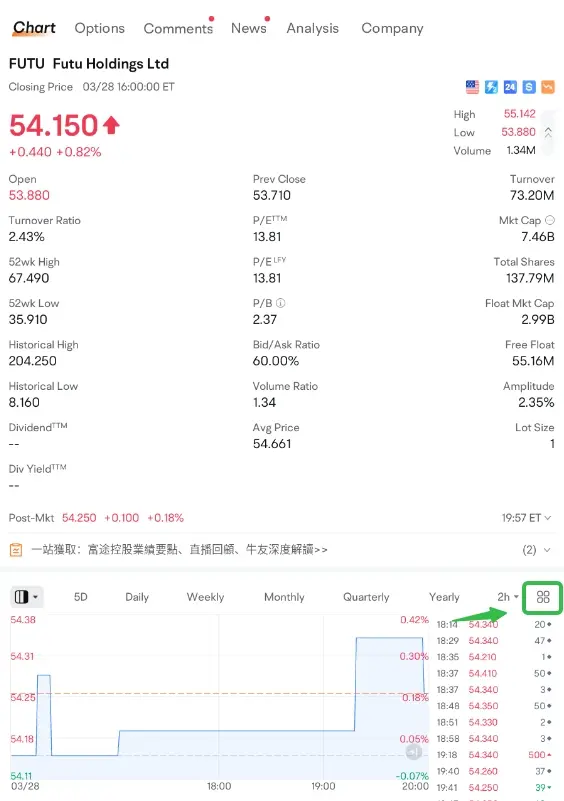

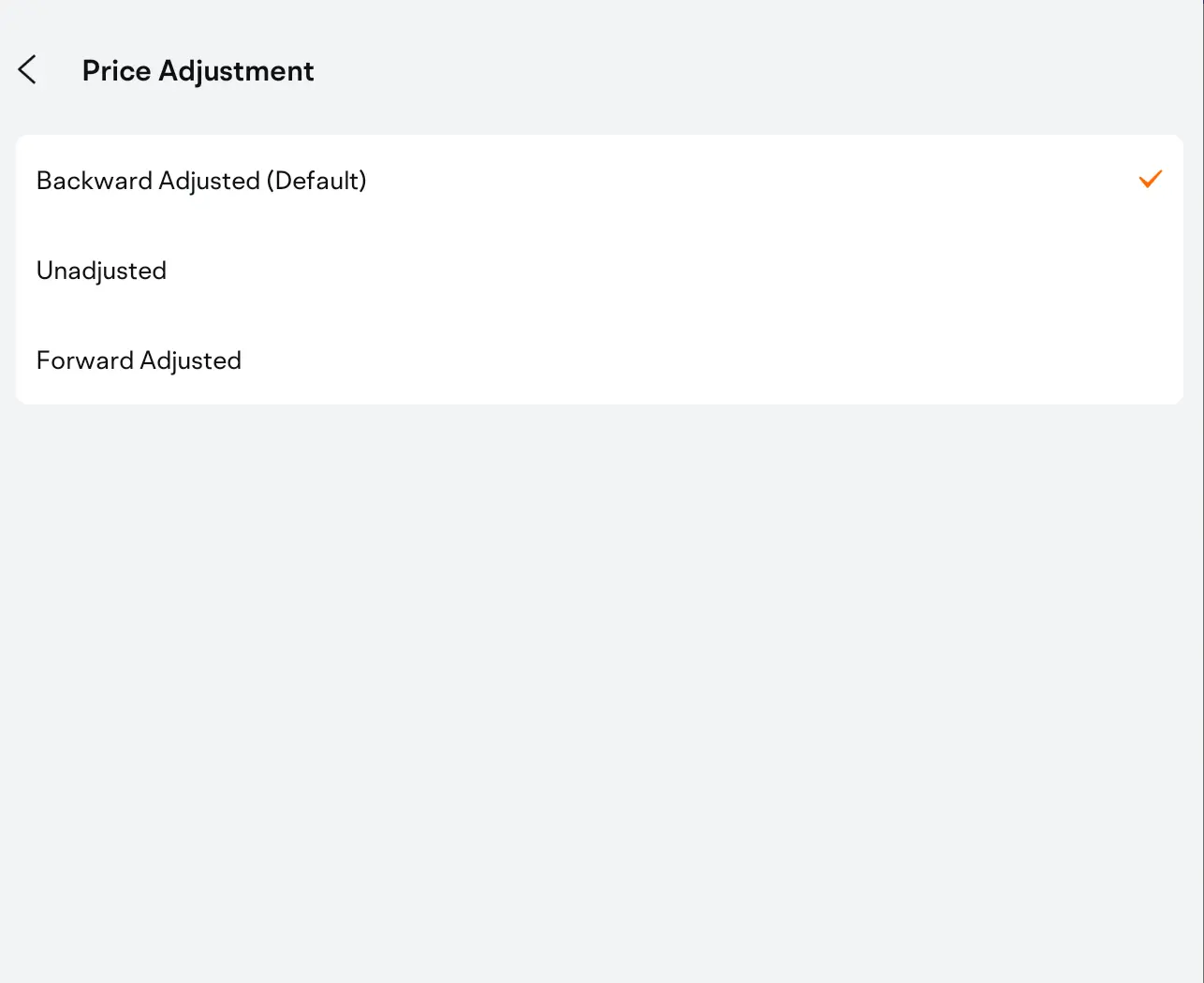

4. How to switch the stock price adjustment type

To switch the stock price adjustment type on the mobile app, go to:

1. Stock Quotes page > Chart

2. Tap the grid icon in the top right corner of the chart

4. Go to Settings > Price Adjustment

5. Switch between Backward Adjusted, Forward Adjusted, and Unadjusted

|

|

|

|

To switch the stock price adjustment type on the desktop app, go to:

-

Stock Quotes page > Chart

-

Click the Backward Adjusted, Forward Adjusted, or Unadjusted in the top right corner of the chart

-

Select a Price Adjustment method

Note: The screenshots and related information are for reference only. Please refer to the latest version of the app. The securities shown in the screenshots are for illustration purposes only and do not constitute any investment advice.

Overview

- No more -