Market Position Overview

1. Definition

Also known as the market position overview of float (shares that are available for trading by the public), the Function presents the number of shares held at different prices by investors.

2. Usage Guide

2.1 Reading the Graph

a) Colors (As per the 「Quote Color」 setting in the App. Here "Green Up / Red Down" is used as an example)

Green: profitable positions; position cost < current stock price

Red: loss-making positions; position cost > current stock price

Gray: neutral positions; position cost = current stock price

Blue: current stock price

b) Terminology

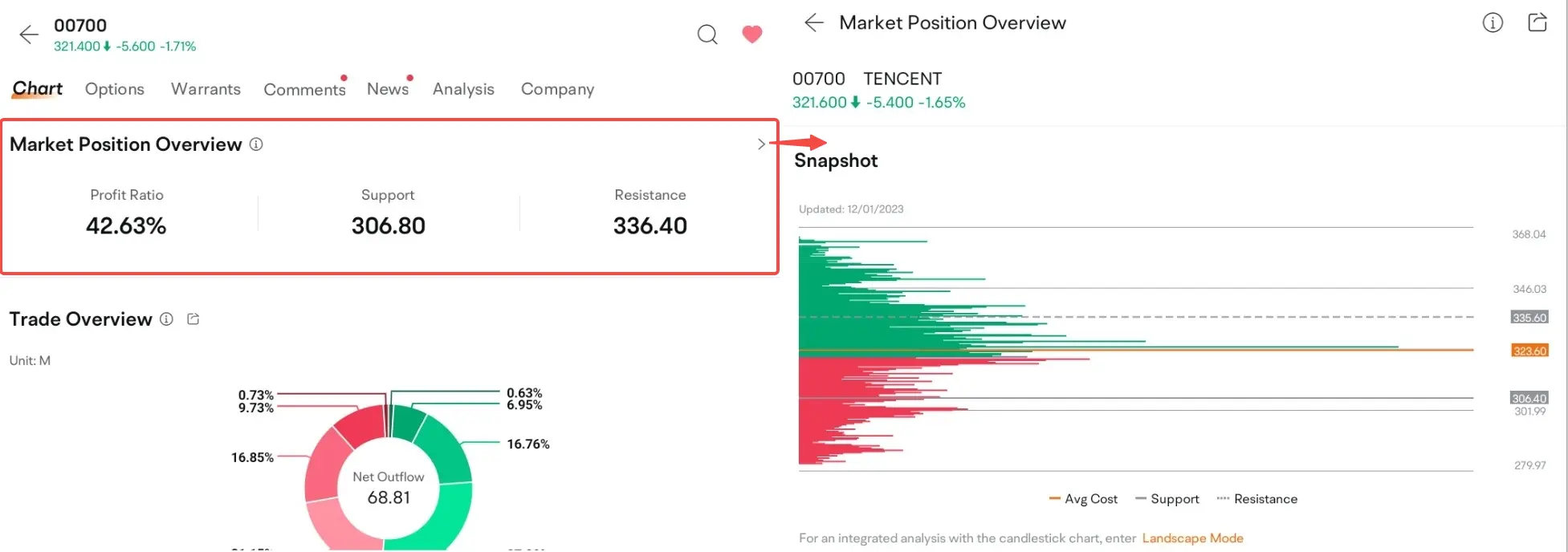

Profit Ratio: the proportion of profitable positions

Average Cost: the average price of all positions

Resistance: the average price of loss-making positions

Support: the average price of profitable positions

90% Position Cost Range: the price range of 90% of all positions

70% Position Cost Range: the price range of 70% of all positions

Degree of Overlap: the extent to which the two Ranges overlap. The greater the Degree of Overlap, the more concentrated the positions and the more moderate the stock price fluctuation.

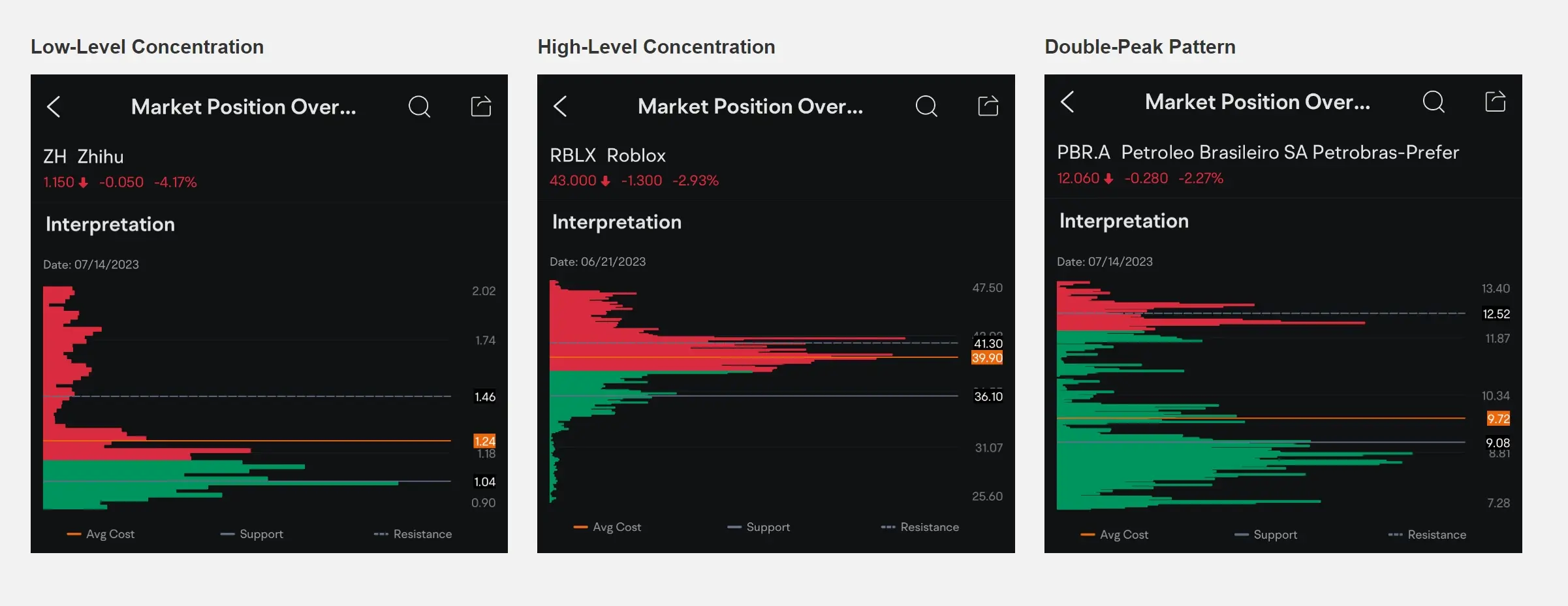

2.2 Interpreting Patterns

a) Low-Level Concentration: As the stock price falls, position costs gradually decrease. When most of the positions are concentrated to the low price level, the resistance weakens and a rise in stock price is possible.

b) High-Level Concentration: As the stock price rises, position costs gradually increase. When most of the positions are concentrated to the high price level, it may indicate that the low-cost positions have already exited after taking profit and that a momentum to fall is gathering strength.

c) Double-Peak Pattern: This pattern mostly occurs in stocks with repeated price fluctuations within a certain range. The upper peak can be regarded as the resistance and the lower support. Investors may be better off if they 「sell high and buy low」 in accordance with the rhythm of price fluctuations.

3. Accessing the Function

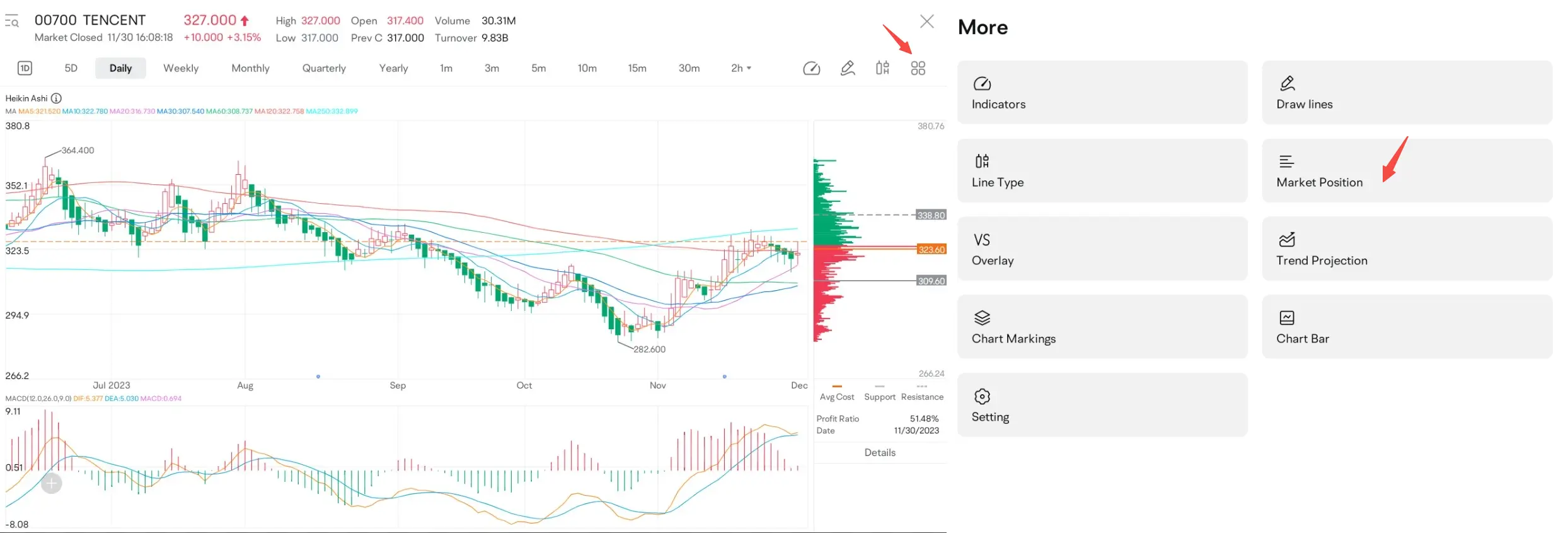

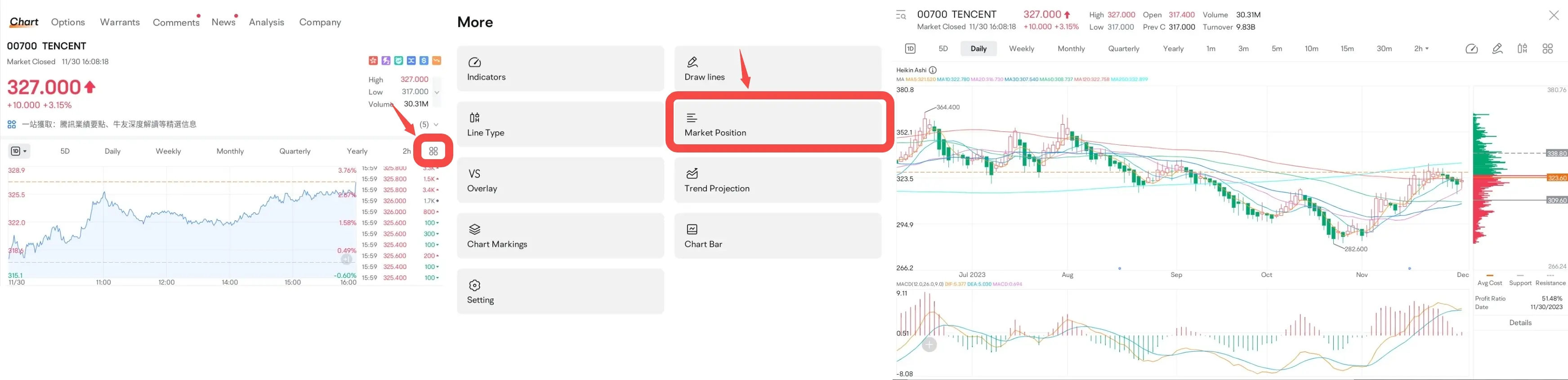

3.1 Stock Detailed Quotes > 1D (Candlestick Chart) > Landscape mode > Market Position

3.2 Stock Detailed Chart > Toolbox > Market Position

3.3 Stock Detailed Chart > Swipe down > Market Position Overview

Note: All the data and information above are for reference only and do not constitute any investment advice.

Overview

- 1. Definition

- 2. Usage Guide

- 2.1 Reading the Graph

- 2.2 Interpreting Patterns

- 3. Accessing the Function

- 3.1 Stock Detailed Quotes > 1D (Candlestick Chart) > Landscape mode >Market Position

- 3.2 Stock Detailed Chart > Toolbox > Market Position

- 3.3 Stock Detailed Chart > Swipe down > Market Position Overview