Help Center Market Introduction US Stocks Why stock prices in the pre-market different from other platforms

Why stock prices in the pre-market different from other platforms

1. Data sources: The pre-market prices of free users based on Nasdaq Basic LV1 data. Users can get complete extended market data by paying to upgrade to National LV1 data.

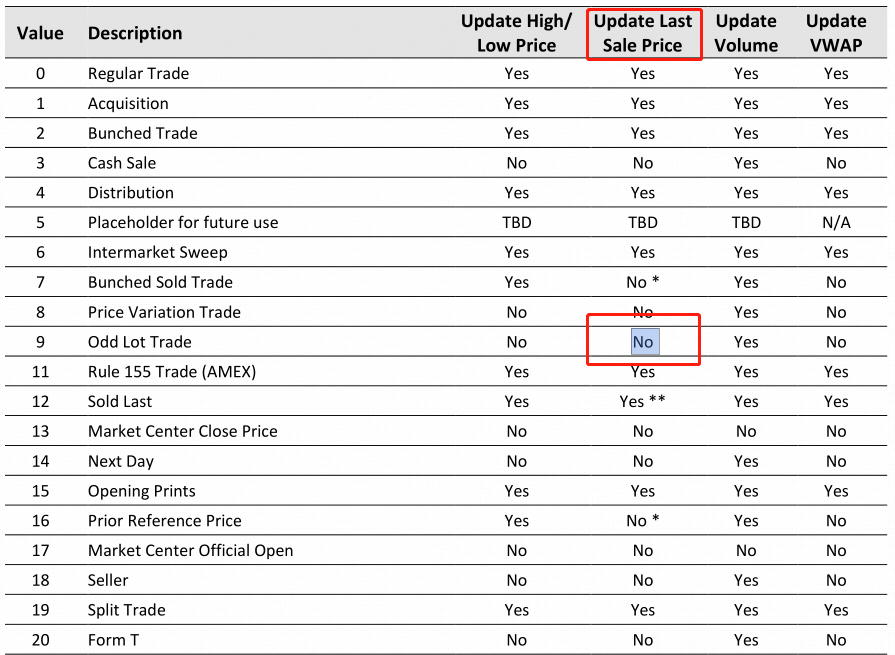

2. Odd lots: Round lots are defined by the exchanges and generally refer to quotes to buy or sell 100 shares of a given security or a larger number of shares divisible by 100. Odd lots, or orders for fewer than 100 shares, are not included in the NBBO and are not currently distributed by the SIPs.

Market Insights

HK Tech and Internet Stocks HK Tech and Internet Stocks

Stocks of companies primarily involved in technology and internet sectors in the HK stock market. Stocks of companies primarily involved in technology and internet sectors in the HK stock market.

View More

Nancy Pelosi Portfolio Nancy Pelosi Portfolio

Former U.S. House Speaker Pelosi, renowned as the "Stock Market Queen" in politics, concentrates her investment portfolio on tech giants in AI and semiconductors. Her core strategy involves purchasing call options for leveraged trading to maximize potential returns. Former U.S. House Speaker Pelosi, renowned as the "Stock Market Queen" in politics, concentrates her investment portfolio on tech giants in AI and semiconductors. Her core strategy involves purchasing call options for leveraged trading to maximize potential returns.

Invest with Futu! Invest with Futu!

Hot Topics Hot Topics

Trump cheers on towards 100,000! Will the Dow continue its surge after breaking through 50,000 point

On February 10 Eastern Time, the Dow Jones Industrial Average hit another all-time high! Previously, on February 6, the Dow surpassed the hi Show More

牛牛課堂

Feb 9 17:49

Is the US stock market entering a recovery phase? Trump and Jensen Huang both 'chiming in' with these three key trends worth watching!

牛头法师

Feb 9 20:39

Wait for the right moment to act

- No more -