How to Determine Buying Power

Due to certain differences between a securities account and a futures account, some Conditions Cards may not apply to both a security strategy and a futures strategy. Therefore, when creating these two types of strategies, different Condition Cards need to be used to implement the same functionality.

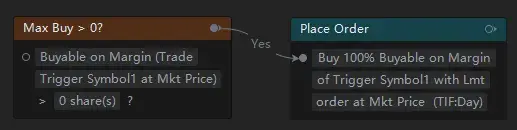

● Security strategy

In the case of a securities strategy, you can determine the maximum number of shares you can buy to open a position by directly using the "Buyable on Margin" card.

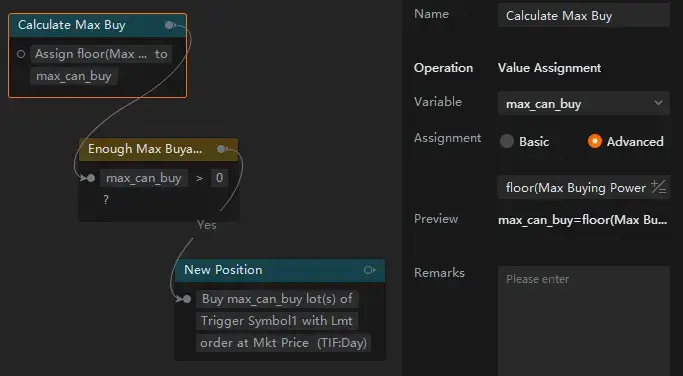

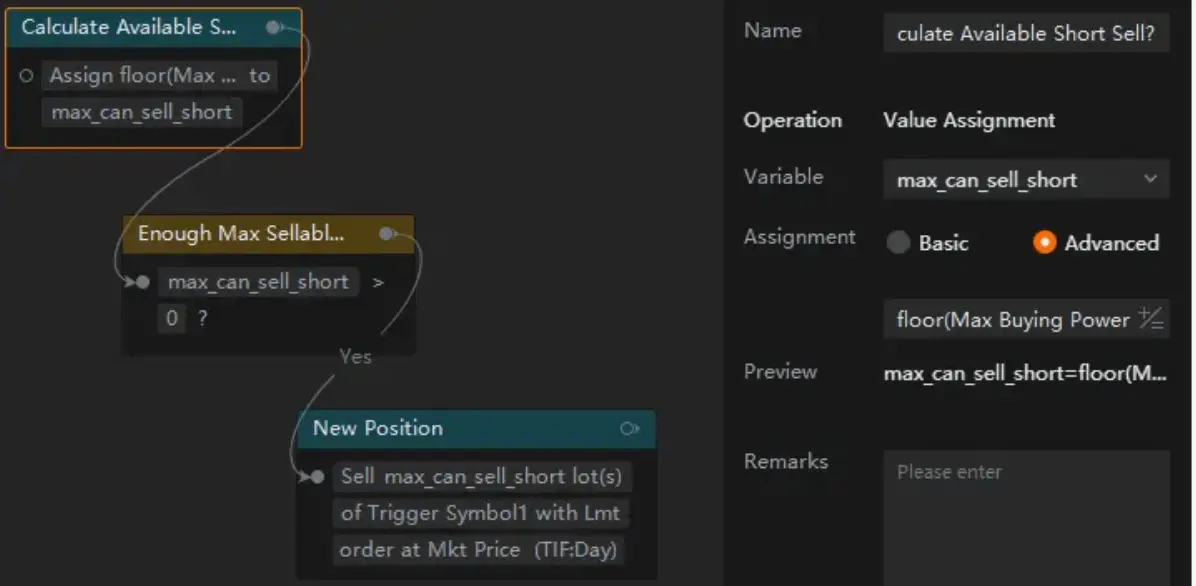

● Futures strategy

In the case of a futures strategy, you need to calculate the maximum number of shares you can buy to open a position, namely, floor (maximum buying power/initial margin per contract to open a long position):

It is the same as the "Sellable". You need to calculate the maximum number of shares you can sell to open a short position, namely, floor (maximum buying power/initial margin per contract to open a short position).

- No more -