A brief overview of Futubull Algo

1. What is algorithmic trading?

To put it simply, algorithmic trading is a process of realizing one’s investment philosophies and strategies by means of computer technologies and certain mathematic models.

Instead of relying on one’s personal feelings to manage assets, algorithmic trading is to convert proper investment thoughts and experience into quantitative models and to process information through computers in order to achieve automatic or semi-automatic trading.

2. How to use Futubull Algo feature?

2.1 Introduction

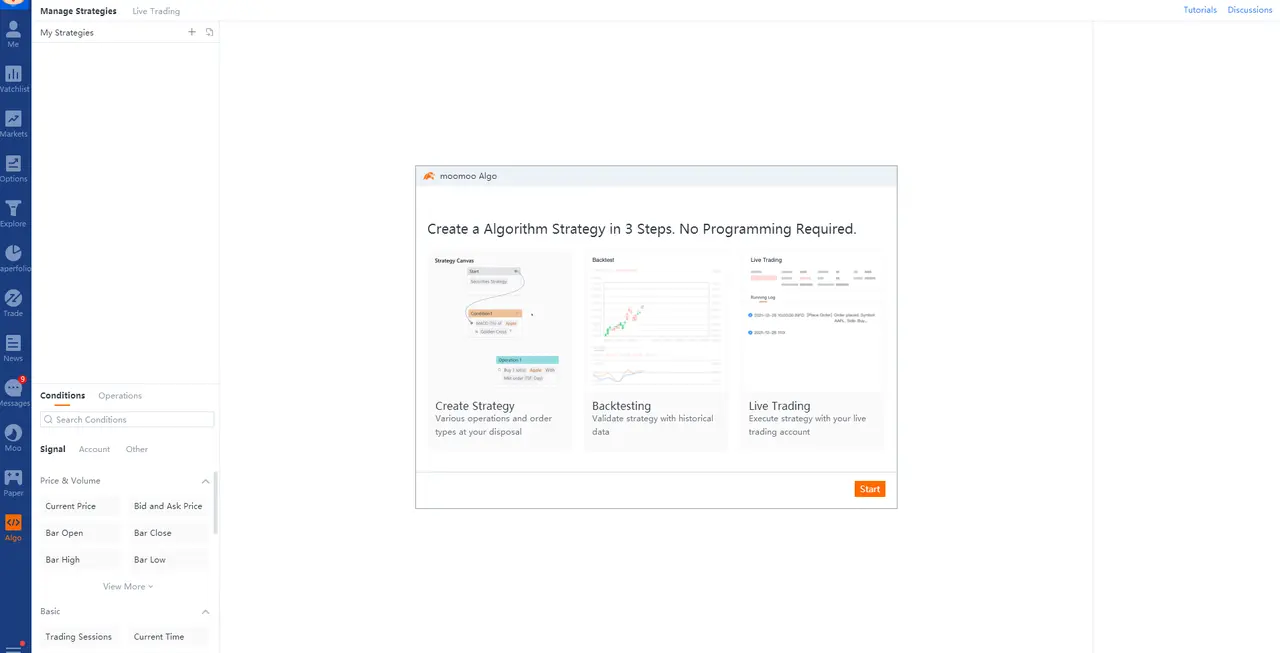

Open Futubull in Windows and click the "Algo" tab on the left.

The interface is designed to be easy. You don’t need to program by yourself in the whole process. All it takes is a few simple steps of clicking and dragging to set up an algorithmic trading strategy and carry out backtest and live trading.

2.2 Onboarding task strategy

The onboarding task will be initiated once you click the "Algo" tab for the first time.

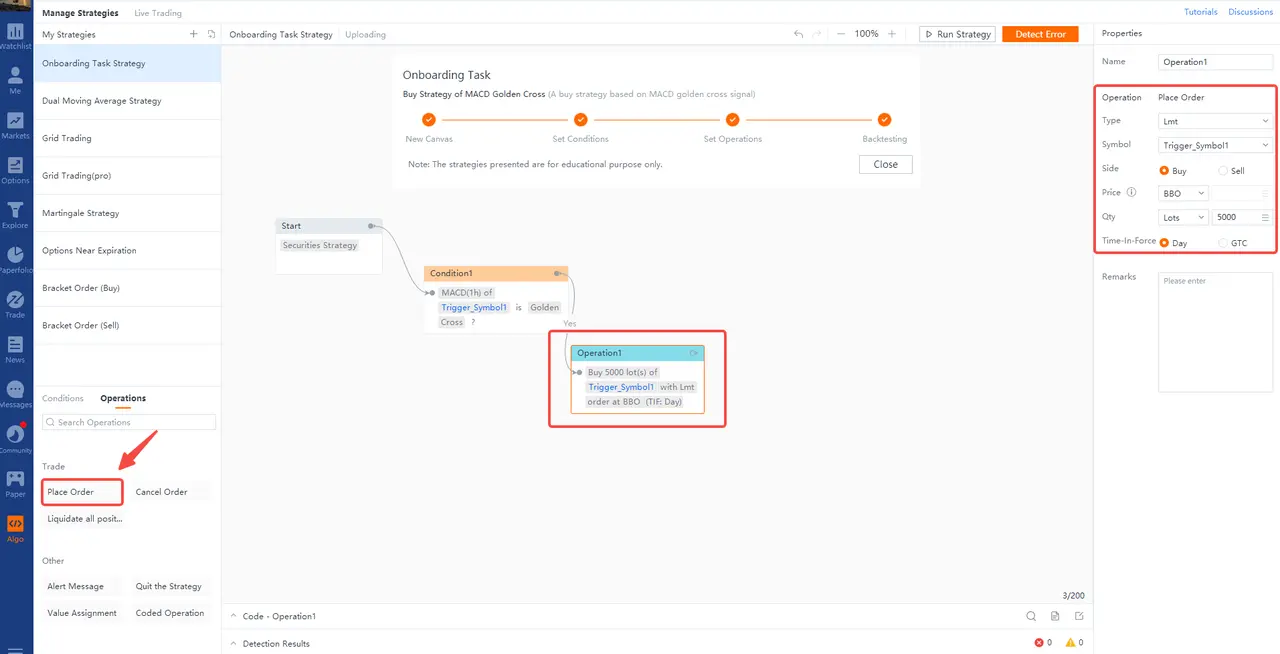

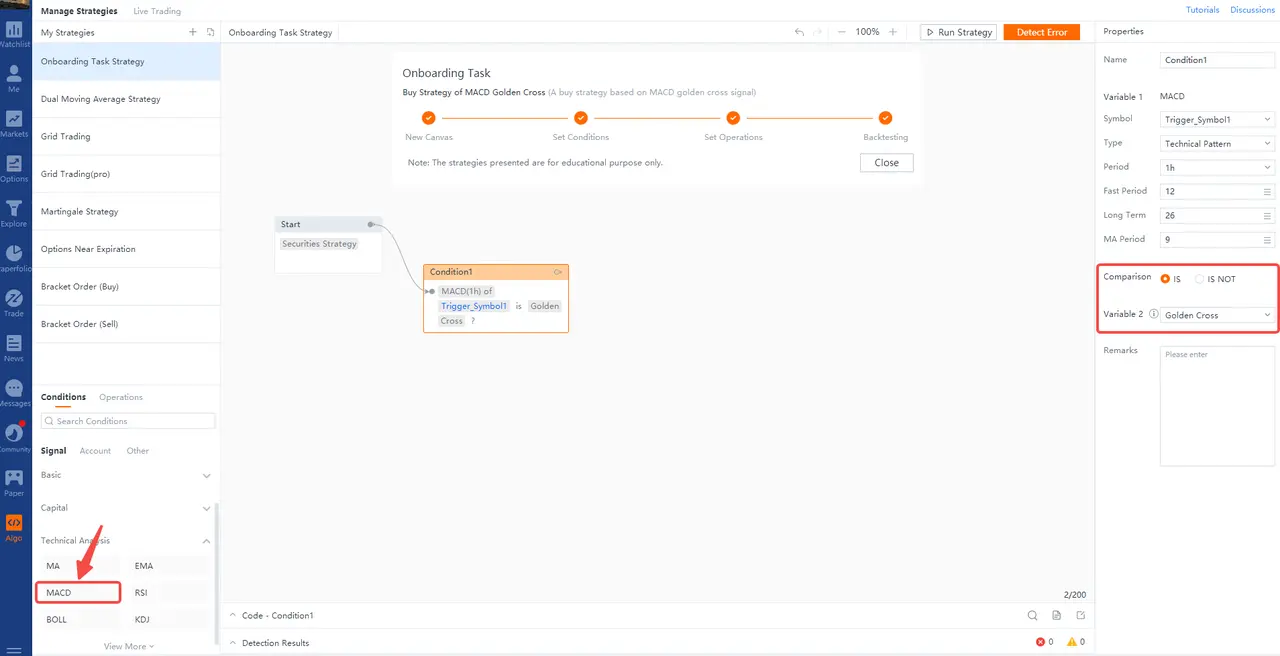

All you need is a Condition and an Operation to establish a simple strategy. The strategy includes 2 important elements: what condition to meet and what operation to execute.

For example, in the onboarding task, the strategy will determine whether a golden cross occurs in the MACD of Trigger Symbol 1.

If yes, a market order of 5,000 board lots will be placed; if no, no operation will be executed.