How to Open and Close Positions

1. Placing an order to open positions

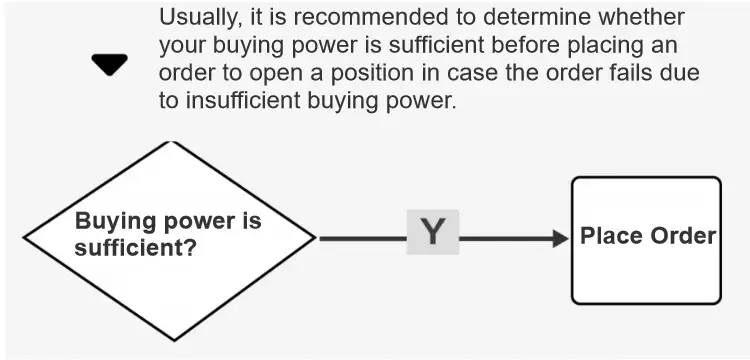

1.1 Determine buying power before placing an order

Usually, it is recommended to determine whether your buying power is sufficient before placing an order to open a position in case the order fails due to insufficient buying power.

Note: Live trading is provided by each securities company.

There are two situations in which you need to determine your buying power:

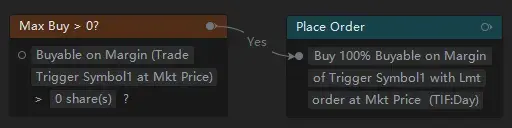

● Buyable on Margin

If you want to buy on margin, you can refer to this method: first determine whether the maximum number of shares you can buy on margin is greater than 0; if so, you can directly select "Buyable on Margin" in the quantity parameter box of "Place Order Card" .

It should be noted that, since the maximum number of shares you can buy on margin varies with order types (limit orders and market orders), the order type selected in the "Buyable on Margin" should be consistent with that selected in the "Place Order Card" .

Note: Live trading is provided by each securities company.

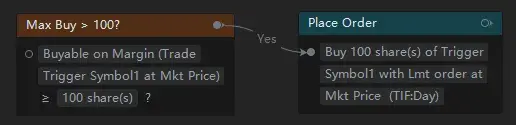

● Buy in a fixed amount

If you want to buy in a fixed amount, you can refer to this method: first determine whether the maximum number of shares you can buy on margin is greater than or equal to 100 shares; if so, you can fill in 100 shares in the quantity box of the "Place Order Card" .

Note: Live trading is provided by each securities company.

1.2 Placing an order for a fixed number of shares vs for a pro rata number of shares

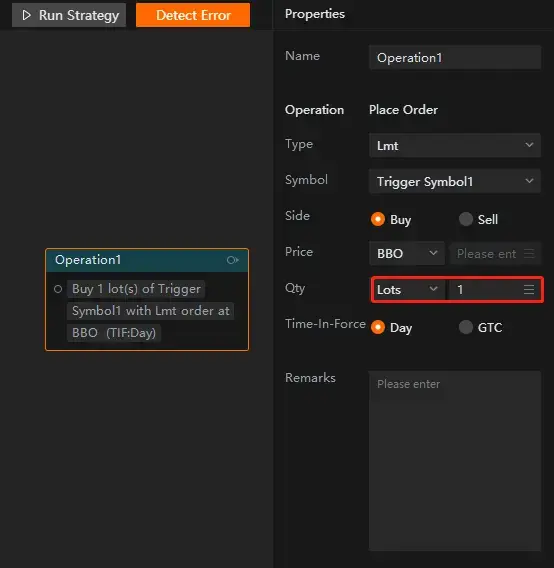

Scenario 1: Placing an order for a fixed number of stocks

If you need to trade a fixed number of underlying stocks, just select "Shares" and enter a value in the "Qty" box of the ”Place Order Card”.

Note: Live trading is provided by each securities company.

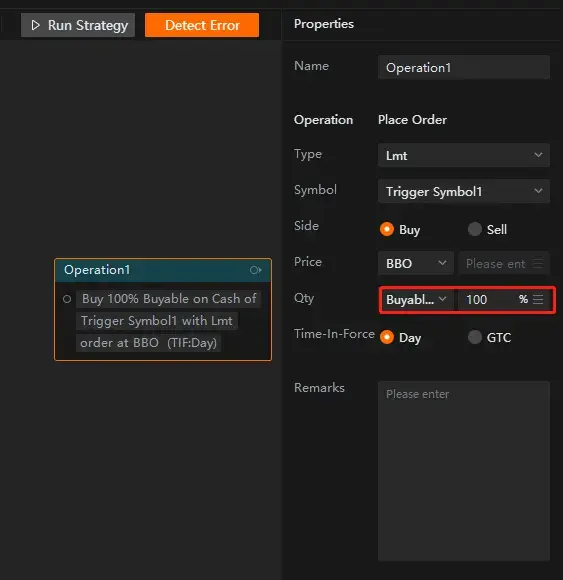

Scenario 2: Placing an order for a pro rata number of shares

If you need to trade a pro rata number of shares (e.g.,100% of available cash), you only need to select "Buyable on Cash" and enter the percentage in the "Qty" box of the ”Place Order Card” .

Note: Live trading is provided by each securities company.

2. Close positions

Similarly, it is also recommended to determine whether "Sellable Positions" or "Short Positions" is sufficient before placing an order to close positions in case the order fails due to the positions being frozen or other reasons.

Here are two situations in which you need to determine your buying power.

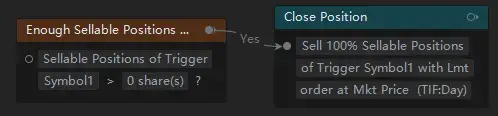

● Sell to close a long position

If you hold a long position and want to sell to close it, you can refer to this method: first determine whether your sellable position is greater than 0; if so, you can directly select "Sellable Positions" in the quantity parameter box of the "Place Order Card".

Note: Live trading is provided by each securities company.

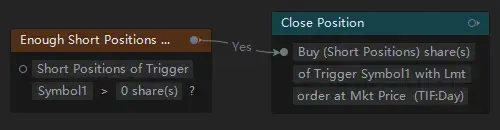

● Buy to close a short position

On the other hand, if you hold a short position and want to buy to close it, you can refer to this method: first determine whether the number of shares you need to buy back is more than 0; if so, you can directly select "Short Positions" in the quantity parameter box of the "Place Order Card".

Note: Live trading is provided by each securities company.